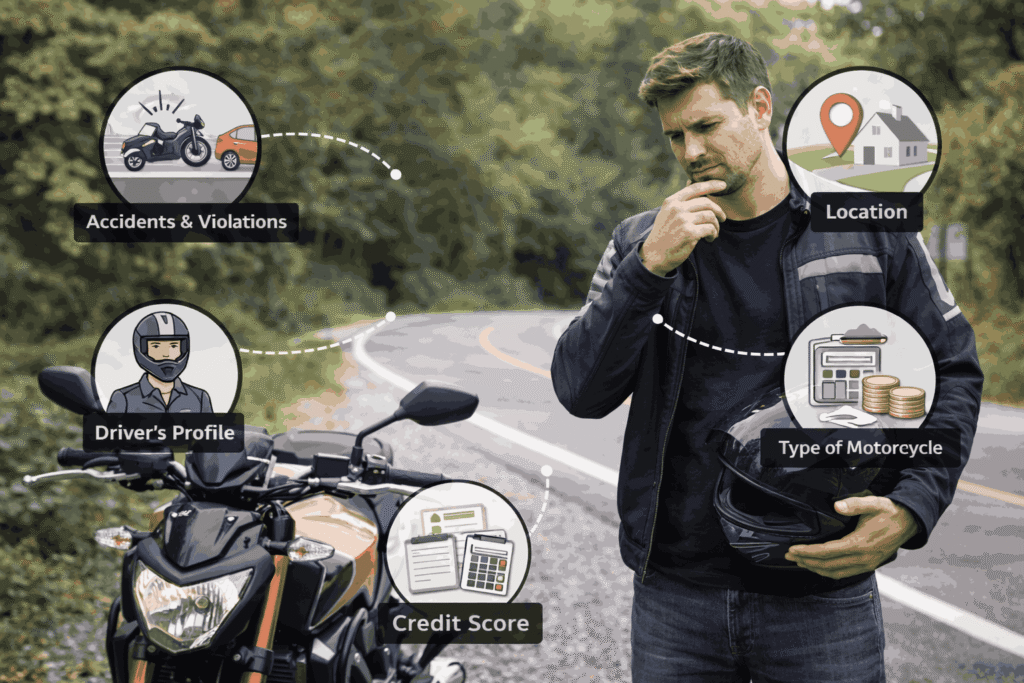

Riding a motorcycle offers freedom and excitement on Ontario’s roads. However, understanding what influences your insurance premiums helps you make informed decisions. Motorcycle insurance in Ontario varies significantly based on several key factors. Whether you’re cruising through Barrie or exploring highways across the province, knowing these elements can help you find coverage that fits your budget and needs.

1. Your Age and Riding Experience

Your age and years of riding experience significantly impact your insurance rates. Younger riders typically face higher premiums because statistics show they’re more likely to be involved in accidents. Insurance companies view inexperienced riders as higher-risk clients.

If you’re a new rider, expect to pay more initially. However, maintaining a clean riding record helps reduce these costs over time. Riders with several years of claim-free experience often qualify for better rates. Completing a recognized motorcycle safety course can also demonstrate responsibility to insurers. Many providers offer discounts for graduates of approved training programs. As you gain experience and age, your premiums generally decrease, rewarding you for safe riding habits.

2. The Type of Motorcycle You Ride

The type of motorcycle you ride plays a crucial role in determining your insurance premiums. Sport bikes with high-performance engines cost significantly more to insure than cruisers or touring bikes. Insurance companies consider factors like engine size, horsepower, and the bike’s theft statistics.

Sport bikes designed for speed carry higher premiums than similar-sized cruisers. These high-performance machines are associated with aggressive riding and higher accident rates. Vintage or custom motorcycles may also require specialized coverage, affecting costs differently. The bike’s value, repair costs, and replacement parts availability all factor into your premium. Before purchasing a motorcycle, research typical insurance costs for that specific model to avoid surprises.

3. Where You Live and Store Your Bike

Your location significantly affects your motorcycle insurance in Barrie and throughout Ontario. Urban areas with higher traffic density, theft rates, and accident statistics typically result in higher premiums. Rural areas often enjoy lower rates due to reduced risk factors.

How you store your motorcycle also matters to insurance providers. Bikes stored in locked garages receive lower premiums than those parked on the street. Secure storage reduces theft risk and weather-related damage. If you live in a high-theft area, investing in additional security measures can help lower your costs. Anti-theft devices like alarms, GPS trackers, and disc locks often qualify for insurance discounts. Some providers offer reduced premiums for approved security systems.

4. Your Driving and Claims History

Insurance companies closely examine your driving record across all vehicles, not just motorcycles. Traffic violations, at-fault accidents, and insurance claims directly impact your premiums. A clean record demonstrates responsible behavior and reduces your perceived risk.

Affordable motorcycle insurance in Ontario becomes more accessible when you maintain a spotless driving history. Even minor infractions like speeding tickets can increase your rates for several years. At-fault accidents have an even more substantial impact on your premiums. If you’ve made multiple claims recently, expect higher costs when renewing or switching policies. Conversely, many insurers offer claim-free discounts that increase annually. Some providers significantly reduce premiums for riders who remain claim-free for extended periods.

5. Your Coverage Options and Deductibles

The level of coverage you choose directly affects your insurance costs. Ontario requires minimum liability coverage, but many riders opt for comprehensive protection. Basic liability coverage costs less but leaves you vulnerable to significant out-of-pocket expenses.

Comprehensive and collision coverage protects your bike against theft, vandalism, and accident damage. However, these additions increase your premiums substantially. Your chosen deductible also plays a major role in cost determination. Higher deductibles lower your monthly or annual premiums, but increase your immediate costs after a claim. Consider your financial situation when selecting deductibles. Optional coverages include:

- Accessory coverage for custom parts and gear

- Roadside assistance for breakdowns and towing

- Replacement cost coverage for newer bikes

- Medical payments coverage for injury expenses

Each additional coverage layer increases your premium. Finding the best motorcycle insurance in Ontario means balancing adequate protection with affordable costs.

Finding the Right Coverage for Your Needs

Motorcycle insurance in Ontario doesn’t have to break the bank when you understand the factors affecting your rates. By maintaining a clean driving record, choosing your bike wisely, and implementing security measures, you can reduce your premiums significantly. Working with an experienced insurance broker helps you compare options across multiple providers.

We specialize in helping riders throughout Simcoe, Barrie, and surrounding areas find personalized motorcycle coverage that fits their budget. Our team takes the time to understand your unique needs and access competitive rates from multiple insurance providers. Contact the Team today to discover how we can make finding the right motorcycle protection easy and stress-free.